by Leigh Wingfeld

Tariffs have been a hot topic in the Capitol since President Trump’s inauguration. With rapid changes in tariff policy over the last 6 months, there has been considerable confusion about what a tariff is and its purpose. The Trump Administration claims that “conditions reflected in large and persistent annual U.S. goods trade deficits constitute an unusual and extraordinary threat to the national security and economy of the United States that has its source in whole or substantial part outside the United States.” The rationale is that by increasing tariffs on foreign goods, more manufacturing and jobs will be created in the U.S. In theory, this will lead to greater economic prosperity, reduced reliance on other nations, and a decrease in the unemployment rate. But are these theories true or just rose-colored glasses? We’re here to clear the murky waters. What is a tariff, and how will it impact your wallet?

What is a Tariff?

As defined by the World Trade Organization, tariffs are “customs duties on merchandise imports“ that “give a price advantage to locally-produced goods over similar goods which are imported,” while also “rais[ing] revenues for governments.” Essentially, imported goods have an additional tax on them to encourage companies to move manufacturing to the country in which a good is sold, or to encourage consumers to purchase local goods. In theory, this is how tariffs function, but reality is much different.

How Tariffs Can Go Wrong

From a national perspective, tariffs can limit economic growth. According to the Tax Foundation, “Revenue is lower on a dynamic basis, a reflection of the negative effect tariffs have on US economic output, reducing incomes and resulting tax revenues. Revenue would fall more when factoring in foreign retaliation, as retaliation would cause US output and incomes to shrink further.” While tariffs might increase government revenue, the negative effects this will have on trade relations and overall economic growth will not be outweighed by revenue. According to J.P. Morgan, the tariffs imposed by the Trump Administration “increas[e] market volatility and creat[e] material headwinds,” which dampen the U.S. ability to grow the economy. From a consumer’s perspective, tariffs are heavily reliant on the assumption that companies will bear the brunt of the economic impact and that the cost will not be on the head of the consumer. Companies maintain their status quo by continuing to use cheap foreign labor and passing the cost of the tariff on to the consumer. If one company did this, the impact on the consumer would not be absurd; yet when multiple companies pass this burden on to the consumer, the burden is unbearable.

How These Tariffs are Different

In an interview with Professor Hartmann, the head of the International Studies Department at Centre, she shared that “Economists would say it’s unusual to put tariffs on countries. Usually, we put tariffs on goods. For example, in the early 2000s, George W Bush put tariffs on steel because [it] is a strategic product that we want to be able to produce domestically. We don’t want to depend on Brazil or India for steel. So tariffs were [placed], but they were put on a specific product, not a specific country. When you put tariffs on a country, it’s much more political.” Many of the U.S.’s closest allies, such as Canada, have been angered by these tariffs. Canada has threatened to decrease trade with the U.S. in forms of natural gas, energy, and lumber; these changes in trade could disrupt almost every sector of the U.S. economy. Using these tariffs as a political conduit is driving away trade partners, which could lead to struggles exporting goods as well as importing goods.

How will Tariffs impact your wallet?

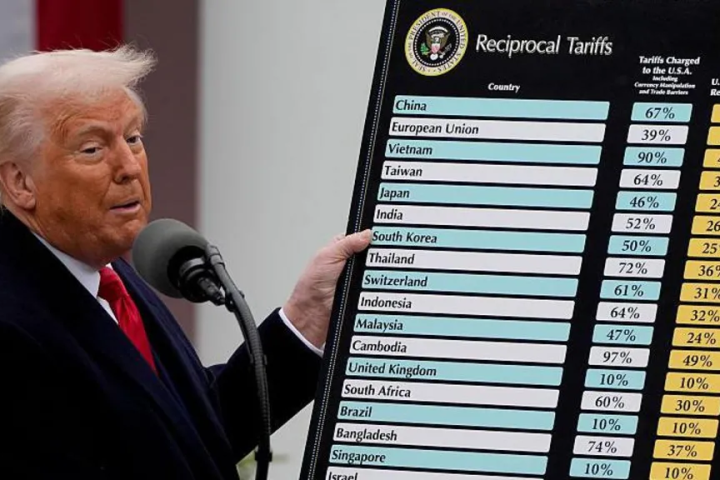

On an individual basis, any foreign good will have increased costs, and some goods may be hard to find as the revenue produced by them is not enough to offset the cost of tariffs. With the persistent cost-of-living crisis and supply chain issues, these tariff policies do little to aid struggling consumers. Tariffs on foreign goods vary depending on the country they are from and are rapidly changing based on continuous trade negotiations. Nonetheless, the state of tariffs in the U.S. will lead to economic uncertainty, concerns about increased rates of inflation, and further supply chain issues. While the end goal is admirable in bringing more jobs and industry to the U.S., the result may not be what was intended. Luckily, not all hope is lost. In an interview with Professor Hartmann, she said the results of these tariffs are unpredictable; a lot still has to play out in the global political and economic landscape.

Some might wonder how tariffs have not exactly hit the table yet. There are many reasons, but most are due to the supply chain and the very companies you buy your goods from. Most of the time, you are buying your goods from Walmart or another major retailer; goods from Walmart are from China. They get made at Chinese factories, then go to a wholesaler who is another company, and often go to another facility or two, maybe owned by Walmart, maybe not. This process does not take a few weeks; it often takes a few months or more. Knowing that if a tariff is put into place, once companies run out of stock, a choice will have to be made: pay some of the tariffs or pass them on. To ease consumers, Walmart might work with suppliers and everyone in the chain to take a portion of the tariff. This system would not be sustainable. If someone asked you to take some of your income, I’m sure you would not let it happen for long. After Walmart and the suppliers have taken on as much of the tariff as possible while only raising prices minimally, typically when all their old inventory is gone and they have done as much as they can to ease the tariffs, they will, unfortunately, have to pass on all of the tariffs to the consumers to stay profitable. With tariffs between 10 and 50 percent, these taxes are much higher than the average tax on goods currently. With a tax increase, US consumers will most likely see an increase in inflation in the United States, as well as potentially in other countries.